What is vTVL?

Virtual Total Value Locked: Why your capital should serve multiple strategies, not just one

TVL Works... Sometimes

TVL is a great metric for some DeFi use cases.

Your $100k deposited in Aave? It's being lent out continuously. Working. Productive. TVL accurately reflects that.

Your ETH staked for consensus? It's securing the network 24/7. Active. Useful. TVL makes sense here too.

But for liquidity providers in AMMs? TVL is completely broken.

The Real Problem: Fragmented Capital, Idle Capital

You're an LP with $100k. You want to provide ETH/USDC liquidity.

But there's not just one place to do it. There are dozens:

- Uniswap V3 on Ethereum

- Curve on Ethereum

- Uniswap V3 on Base

- Aerodrome on Base

- Uniswap V3 on Arbitrum

- Balancer on Arbitrum

Traditional DeFi forces you to choose ONE.

Lock your $100k in Uniswap V3 on Ethereum. That's it. Your capital serves that single strategy on that single chain.

What happens when:

- Curve on Ethereum has better fees? You miss out.

- Base sees high volume but your capital is on Ethereum? You miss out.

- Arbitrum gets a surge of activity? You miss out.

Or worse: you split your capital.

$100k divided across 6 strategies = $16k each.

$16k positions barely earn anything in DeFi.

Compare this to lending: deposit $100k in Aave once, it gets utilized by whoever needs it, whenever they need it. You don't pick which borrower. The protocol optimizes for you.

LPs deserve the same efficiency.

The 90% Idle Problem

Here's what nobody talks about:

Even when your capital IS in the right place, it's mostly idle.

Analysis from 1inch shows:

- Uniswap V2: 94% of liquidity sits unused on 90% of days

- Uniswap V3: 85% unused

- Curve: 83% unused

- Balancer: 97% unused

Your $100k is locked. But only $10k-15k is actually trading at any moment.

The rest? Just sitting there. Not earning. Not working.

This is the fundamental problem with traditional AMM pools: capital is locked in specific pools where it waits for trades that rarely come.

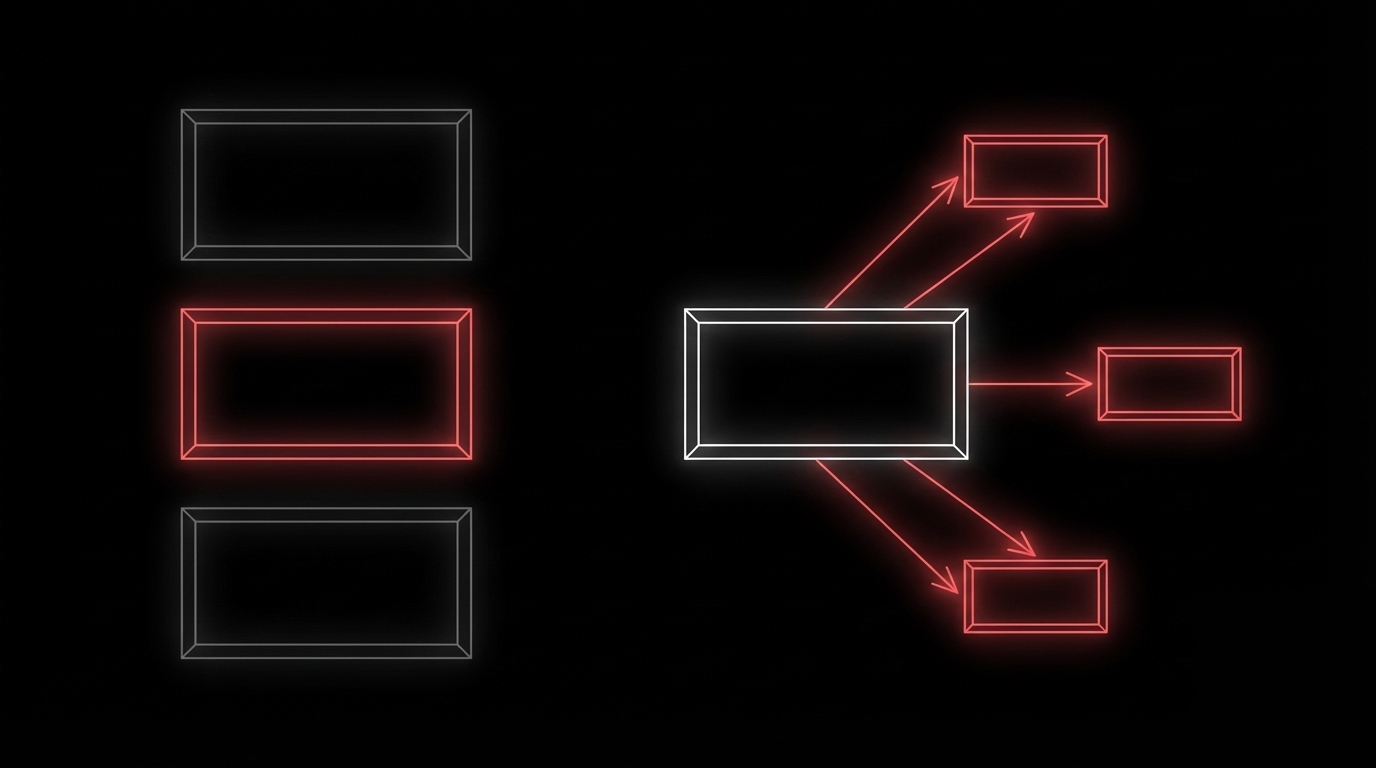

Enter vTVL: Virtual Total Value Locked

vTVL flips the script.

Instead of asking "how much capital is locked in this pool?", vTVL asks: "how many strategies is this capital actively serving?"

Traditional TVL: Your $100k locked in one pool.

vTVL: Your $100k in your wallet, but virtually serving multiple strategies.

How? Through virtual balance accounting.

Here's the key insight: your capital doesn't need to be deposited into a pool to serve that pool.

With virtual balance accounting:

- Your $100k stays in your wallet (non-custodial)

- You approve multiple strategies to use it

- When a trade comes in, the strategy pulls your capital

- Trade executes

- Capital returns to your wallet

- Total time: seconds

Same capital. Multiple strategies. Zero fragmentation.

How 1inch Aqua Pioneered This

This isn't theoretical. 1inch launched Aqua in November 2025 with exactly this capability.

Traditional AMM:

You deposit $100k → Pool locks it → Only that pool can use it

Aqua:

You keep $100k in wallet → Approve 3 strategies → All 3 can pull when needed

Example:

Rick has $100k in USDC and ETH. With Aqua, he approves:

- Uniswap V3 USDC/ETH strategy

- Curve USDC/ETH strategy

- His own custom strategy

All three strategies can access his $100k when they need it.

When someone swaps on Uniswap:

- Uniswap strategy pulls Rick's tokens

- Executes the swap

- Returns tokens to Rick's wallet

When someone swaps on Curve:

- Curve strategy pulls Rick's same tokens

- Executes the swap

- Returns tokens to Rick's wallet

One wallet balance. Three strategies served.

This is vTVL.

What vTVL Measures

vTVL measures the effective liquidity your capital provides.

Traditional LP:

- Deploys $100k

- Serves 1 strategy

- Effective liquidity provided: $100k

- vTVL = $100k

Aqua LP (single-chain):

- Deploys $100k

- Serves 3 strategies on Ethereum

- Each strategy has access to full $100k

- Effective liquidity provided: $300k

- vTVL = $300k

Your wallet has $100k. But the market sees $300k of available liquidity across three strategies.

That's why it's "virtual." Physically, it's $100k in your wallet. Virtually, it's $300k deployed across strategies.

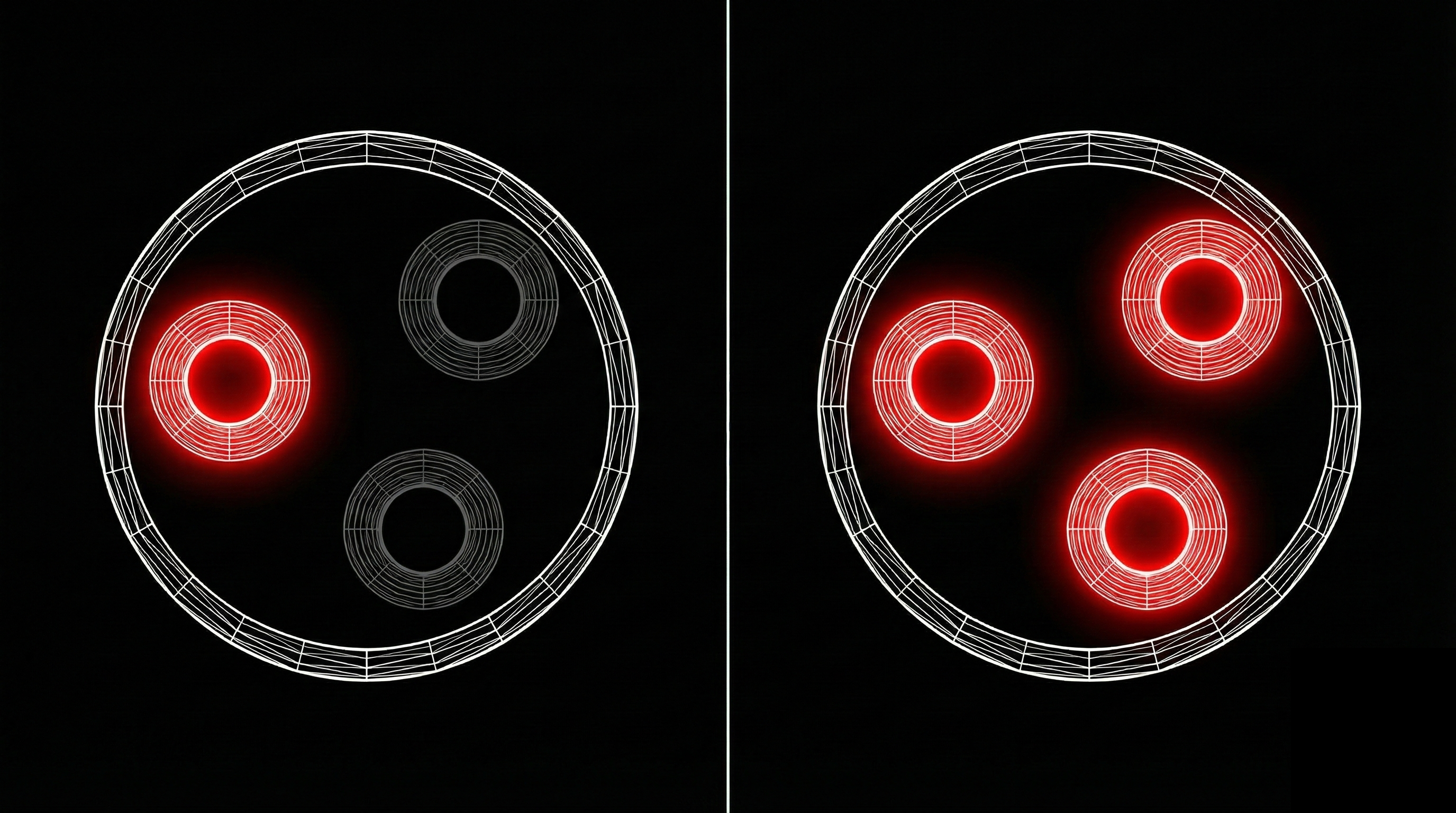

What Aqua0 Adds: Cross-Chain Virtual Liquidity

Aqua solved this for single chains. We're extending it cross-chain.

With Aqua0, your $100k doesn't just serve multiple strategies on Ethereum. It serves strategies across ANY chain.

Example:

You deploy $100k. You approve:

- Uniswap V3 on Base

- Curve on Ethereum

- Aerodrome on Base

- Balancer on Arbitrum

- Velodrome on Optimism

All five strategies, across four chains, can access your capital.

Morning (US hours):

- Base is active

- Your $100k gets pulled to Base

- Serves Uniswap + Aerodrome trades

- Returns to your wallet on Ethereum

Afternoon (Europe hours):

- Ethereum gets active

- Your $100k already there

- Serves Curve trades immediately

Evening (Asia hours):

- Arbitrum sees volume

- Your $100k pulled to Arbitrum

- Serves Balancer trades

- Returns to Ethereum

One capital position. Five strategies. Four chains.

vTVL = $500k (your $100k serving 5 strategies)

The Math: Why This Matters

Traditional Multi-Chain LP:

- Wants to serve 5 strategies across 3 chains

- Options:

- Deploy $100k in ONE strategy → miss 4 other opportunities

- Split $100k across 5 strategies → $20k each (too small)

- Deploy $500k total ($100k per strategy) → most LPs don't have this

Aqua0 LP:

- Deploy $100k once

- Approve 5 strategies

- All 5 can access it when needed

- vTVL: $500k effective liquidity from $100k capital

You deploy 5x less capital. Provide same liquidity to market.

Why This Changes Everything

With vTVL, your capital is no longer stuck in one place at one time.

Traditional AMM forces you to predict:

- Which pool will have volume

- Which chain will be active

- Which strategy will perform best

Get it wrong? Miss fees. Get it right? Still only earning from one position.

With vTVL, you don't predict. You participate everywhere.

Your capital automatically serves whoever needs it, whenever they need it, wherever they need it.

When Base is hot → your capital is there. When Ethereum spikes → your capital is there. When Arbitrum sees volume → your capital is there.

You stop leaving money on the table.

The Connection to Returns

More strategies served = more opportunities = more fees.

Traditional:

- $100k in one strategy

- That strategy active 10% of time

- Earning ~5-8% APY

Aqua0:

- $100k serving 5 strategies

- At least one strategy always active

- High utilization across multiple sources

- Earning ~15-30% APY

Same capital. 2-4x better returns.

This isn't about replacing TVL everywhere. Lending protocols, staking—TVL works fine there.

This is about fixing TVL where it's broken: for LPs who want capital efficiency without fragmentation.

Read next: SLAC Explained: Measuring Your Capital Amplification →

Questions or feedback? Reach out on Twitter