SLAC Explained

Shared Liquidity Amplification Coefficient: How $100k becomes $500k of market liquidity

The Question vTVL Didn't Answer

In our last post, we explained how your capital can serve multiple strategies through virtual balance accounting.

But here's what we didn't quantify: How much liquidity does your capital actually provide to the market?

If you have $100k and it serves 5 strategies, the market sees $500k of available liquidity.

That 5x multiplier? That's your SLAC.

What Is SLAC?

SLAC (Shared Liquidity Amplification Coefficient) is simple:

SLAC = (Total notional liquidity provisioned) / (Your actual capital)

Example:

- You have $100k in your wallet

- You approve 5 strategies to use it

- Each strategy shows $100k available liquidity

- Total liquidity to market: $500k

- SLAC = 5x

The higher your SLAC, the more liquidity you're providing per dollar of capital.

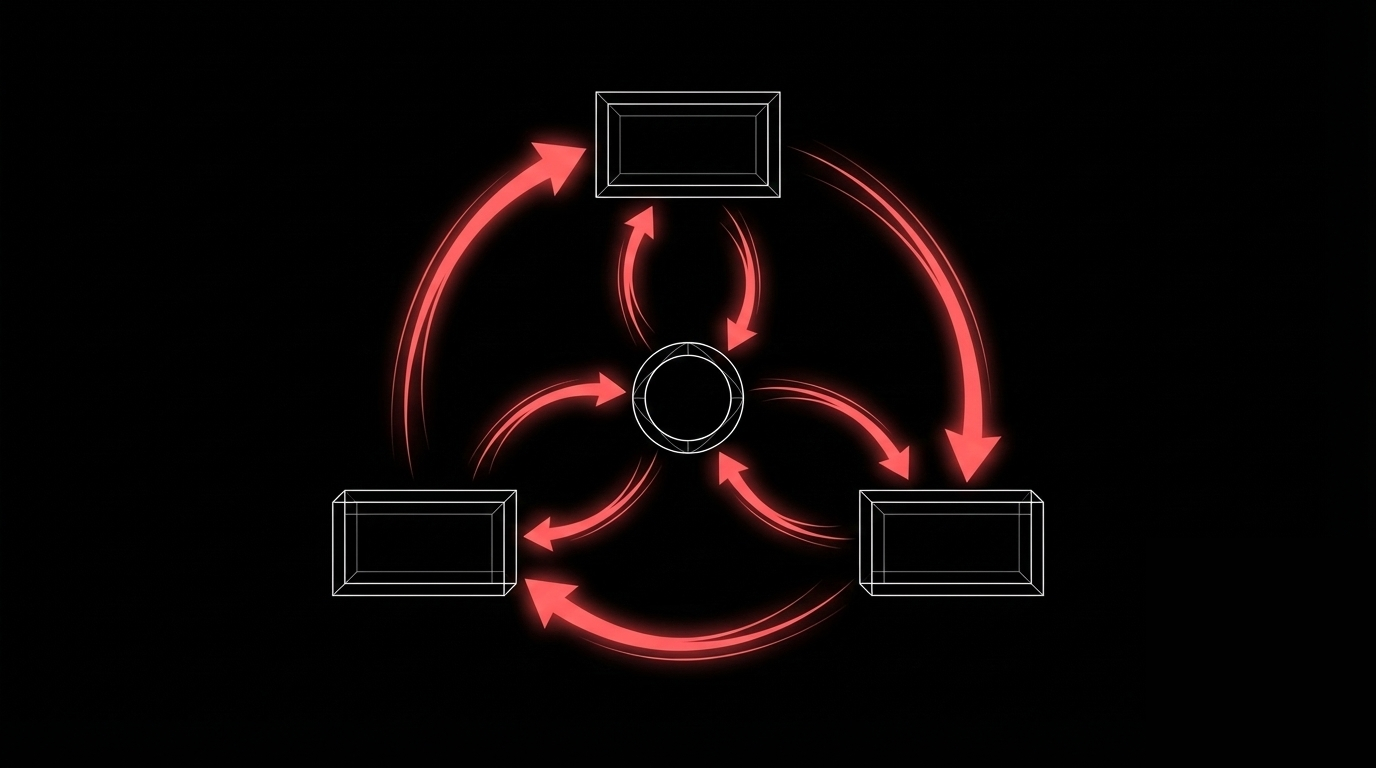

The Two Components of SLAC

According to 1inch's research, SLAC comes from multiplying two factors:

SLAC = Leverage × Strategy Sharing

Component 1: Leverage

Using borrowed capital to amplify your position.

Example:

- You have $100k USDC

- Deposit in Aave as collateral

- Borrow $200k more stablecoins

- Now you have $300k to deploy

- Leverage: 3x

Component 2: Strategy Sharing

Same capital serving multiple strategies.

Example:

- Your $300k (from leverage)

- Approve 3 strategies to use it

- Each sees $300k available

- Total notional: $900k

- Sharing: 3x

Combined SLAC = 3x leverage × 3x sharing = 9x

This is from 1inch's whitepaper example: $100k equity becomes $900k notional liquidity.

Aqua0's Approach: Sharing Without Leverage

We focus exclusively on strategy sharing across chains.

Why no leverage?

Leverage adds risk:

- Liquidation risk if prices move against you

- Borrowing costs eat into returns

- Complexity in managing debt positions

We believe most LPs want efficiency without additional risk.

Our model:

- You deploy $100k (no borrowing, no leverage)

- Approve 5-8 strategies across multiple chains

- SLAC: 5-8x (purely from sharing)

You're providing 5-8x the liquidity to the market with zero leverage risk.

Real Example: Aqua0 SLAC in Action

Your position:

- Capital: $100k USDC + ETH in your wallet

- Approved strategies: 6

Strategies:

- Uniswap V3 on Base

- Curve on Ethereum

- Aerodrome on Base

- Balancer on Arbitrum

- Velodrome on Optimism

- Pancakeswap on BSC

Math:

- Each strategy can access your full $100k

- Total notional liquidity: $600k

- SLAC = 6x

What this means:

- Traders on Base see $100k available liquidity (from you)

- Traders on Ethereum see $100k available liquidity (from you)

- Traders on Arbitrum see $100k available liquidity (from you)

- All at the same time

You deployed $100k. The market sees $600k.

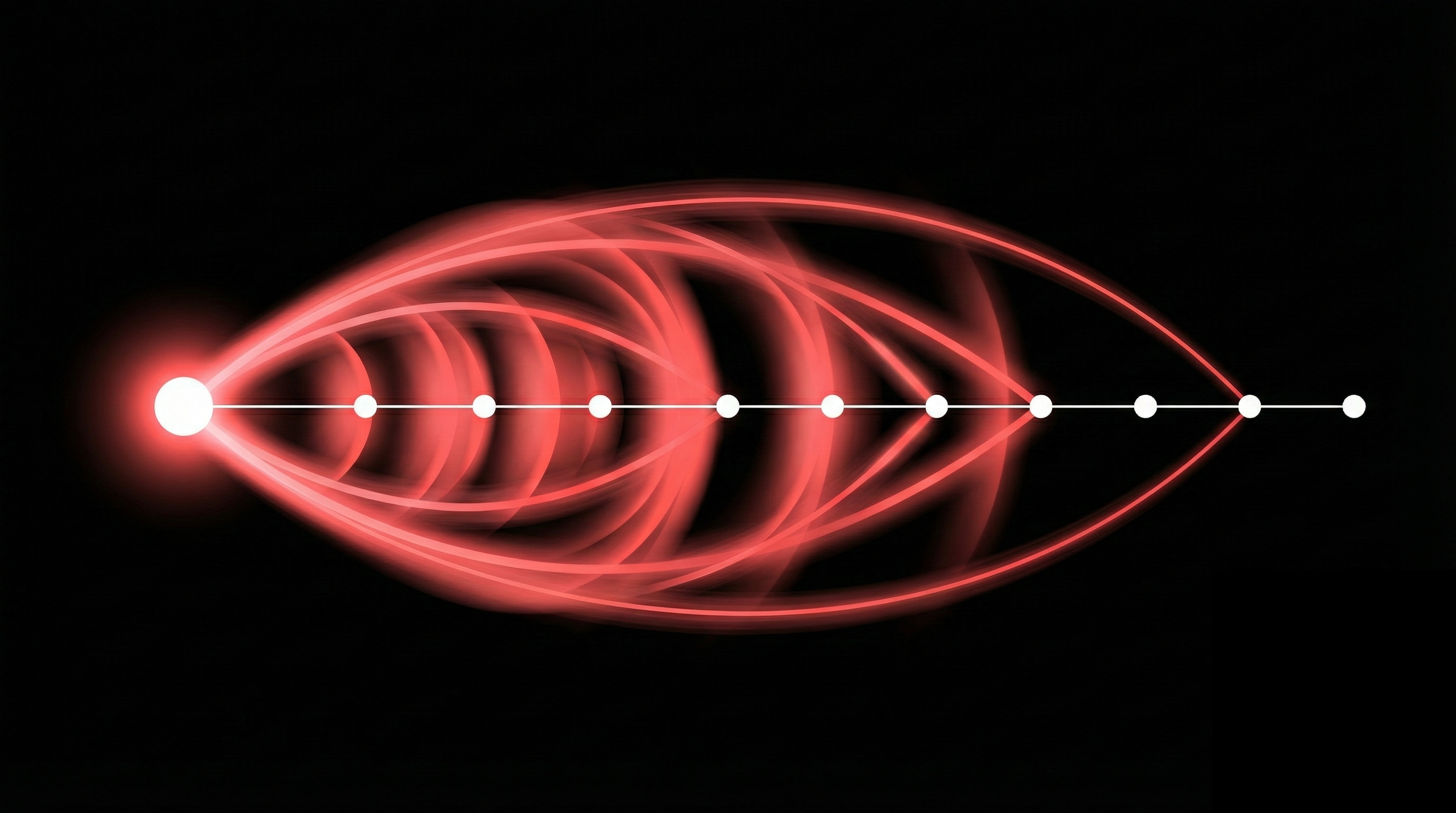

Why SLAC Matters: The Fee Multiplier

Higher SLAC = more fees earned.

Traditional LP (SLAC 1x):

- $100k in one Uniswap pool

- Pool active 10% of time

- Earning fees 10% of time

- ~5-8% APY

Aqua0 LP (SLAC 6x):

- $100k serving 6 strategies

- At least one strategy active most of the time

- Earning fees 60-80% of time

- ~15-25% APY

Why? Because you're capturing opportunities across:

- Multiple chains (when Base is hot, you're there)

- Multiple protocols (when Curve has volume, you're there)

- Multiple time zones (US morning → EU afternoon → Asia evening)

Your capital is where the action is, whenever the action happens.

The Practical Limits

1inch's research shows SLAC caps around 10x due to:

- Coordination overhead - More strategies = more complexity

- Timing conflicts - If 3 strategies need capital simultaneously, you can only serve one

- Gas costs - Moving capital frequently eats into profits

Aqua0 targets SLAC 5-8x because:

- 5-8 strategies is optimal for cross-chain coordination

- Diminishing returns beyond 8x

- Sweet spot between efficiency and manageability

Can You Add Leverage?

Yes, if you want higher SLAC.

Example:

- Your $100k equity

- 2x leverage via Aave → $200k total

- Share across 5 strategies

- SLAC = 2x × 5x = 10x

But remember: leverage adds risk. You're now managing:

- Liquidation thresholds

- Borrowing costs

- Debt positions

We don't promote leverage. But Aqua0 is composable with money markets if you choose to use them.

SLAC vs Volume-to-TVL Ratio

SLAC measures liquidity multiplication (how much liquidity you provide).

Volume-to-TVL measures capital efficiency (how much trading volume you facilitate).

Both are related:

- Higher SLAC → more strategies served → more volume captured → higher ratio

We'll explore Volume-to-TVL in our next post.

The Bottom Line

SLAC quantifies your capital's productivity.

Traditional AMM:

- $100k deployed

- Serves 1 pool

- SLAC = 1x

- Market sees $100k liquidity

Aqua0:

- $100k deployed

- Serves 6 strategies across 4 chains

- SLAC = 6x

- Market sees $600k liquidity

Same capital. 6x the market impact. 3-5x the fees.

Read next: Volume-to-TVL Ratio: Why Efficiency Beats Size →

Previous: What is vTVL? ←

Questions or feedback? Reach out on Twitter